33+ 50 debt to income ratio mortgage

On the other hand if your gross monthly income is. Youll usually need a back-end DTI ratio of 43 or less.

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income.

. Ideally lenders prefer a debt-to-income ratio. Ad Compare Mortgage Options Calculate Payments. Get Instantly Matched With Your Ideal Mortgage Lender.

Ad 10 Best House Loan Lenders Compared Reviewed. Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Web Lets look at a real-world example.

Lock Your Rate Today. Conventional Loans Dont Have To Be Complicated. Apply Now With Quicken Loans.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Ad 10 Best House Loan Lenders Compared Reviewed. If your home is highly energy-efficient.

Ad Compare Mortgage Options Calculate Payments. Web To calculate your debt-to-income ratio add up your total recurring monthly obligations such as mortgage student loans auto loans child support and credit card. Ad See what your estimated monthly payment would be with the VA Loan.

Heres how lenders typically view DTI. Web Trusted VA Home Loan Lender of 300000 Military Homebuyers. Get Instantly Matched With Your Ideal Mortgage Lender.

130 minimum monthly payment. Web How to get a loan with a high debt-to-income ratio. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Banks with total assets of at least 10 billion and removing purer investment banks such as Goldman Sachs Group Inc. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. We Can Help You Discover Your Options.

What More Could You Need. Get Your Estimate Today. Web Here are debt-to-income requirements by loan type.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web A good debt-to-income ratio for a mortgage is generally no more than 36 and lower is better because it shows lenders you are unlikely to default. Apply Now With Quicken Loans.

Bank Is One Of The Nations Top Lenders. Web So if you paid monthly and your monthly mortgage payment was. Comparisons Trusted by 55000000.

Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent 2000 is 33 percent of 6000. Web Starting with a list of US. A high debt-to-income ratio can result in a turned-down mortgage application.

What More Could You Need. Lock Your Rate Today. Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100.

Luckily there are ways to get. Comparisons Trusted by 55000000.

What Is Debt To Income Ratio And Why Does It Matter Consumerfinance Gov Youtube

Annual Report 2003 2004

Upstart Deep Dive By Brad Freeman Stock Market Nerd

Debt To Income Ratio To Be Able To Qualify For A Mortgage

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income First Mortgage Purchase

Betterment Resources Original Content By Financial Experts

Debt Ratio Formula Calculator With Excel Template

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Debt To Income Ratio Calculator Moneygeek Com

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Home Mortgage Debt To Disposable Personal Income Ratio In The Us Download Scientific Diagram

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

![]()

Debt To Income Ratio Calculator The Motley Fool Uk

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

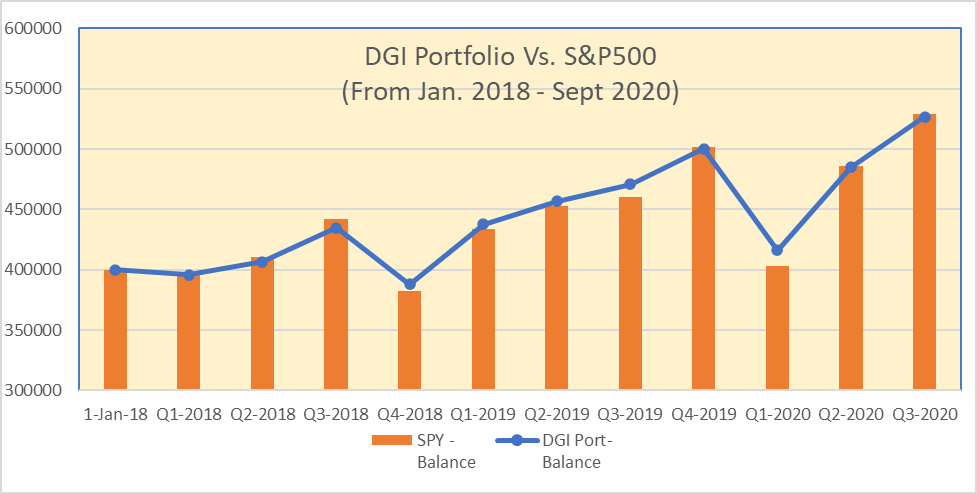

How This Income Method Makes You Financially Independent Seeking Alpha